How to Trade Gold in 2026: A Higher Price Anchor Under Structural Support

By Dilin Wu - Research Strategist

Gold Outlook for 2026: Ongoing central bank buying, shifts in the dollar and interest rates, geopolitics, and ETF flows continue to underpin prices. The price anchor is likely to move higher—while rational and flexible positioning remains key.

Looking back at 2025, gold delivered one of the most striking performances across global markets. Prices repeatedly pushed to new highs, breaking historical records more than 50 times, with peak gains reaching as much as 67%.

In historical terms, this marked the strongest annual performance since 1979. In relative terms, gold significantly outperformed major equity benchmarks such as the S&P 500 and the Nasdaq.

Gold Outlook for 2026: Ongoing central bank buying, shifts in the dollar and interest rates, geopolitics, and ETF flows continue to underpin prices. The price anchor is likely to move higher—while rational and flexible positioning remains key.

Looking back at 2025, gold delivered one of the most striking performances across global markets. Prices repeatedly pushed to new highs, breaking historical records more than 50 times, with peak gains reaching as much as 67%.

In historical terms, this marked the strongest annual performance since 1979. In relative terms, gold significantly outperformed major equity benchmarks such as the S&P 500 and the Nasdaq.

What stood out even more was the breakdown of traditional correlations. Under conventional trading logic, gold typically moves inversely to interest rates or risk assets. Yet over the past year, gold and U.S. equities rose side by side—an unusual and telling development. This signals a fundamental shift in how the market is pricing gold.

As the year draws to a close, traders are asking two key questions: can the bullish momentum of 2025 extend into 2026? And what forces may continue to support gold—or cap its upside—from here?

What Drove Gold Higher in 2025?

Gold’s rally in 2025 was not the result of a single catalyst, but rather the convergence of several powerful forces.

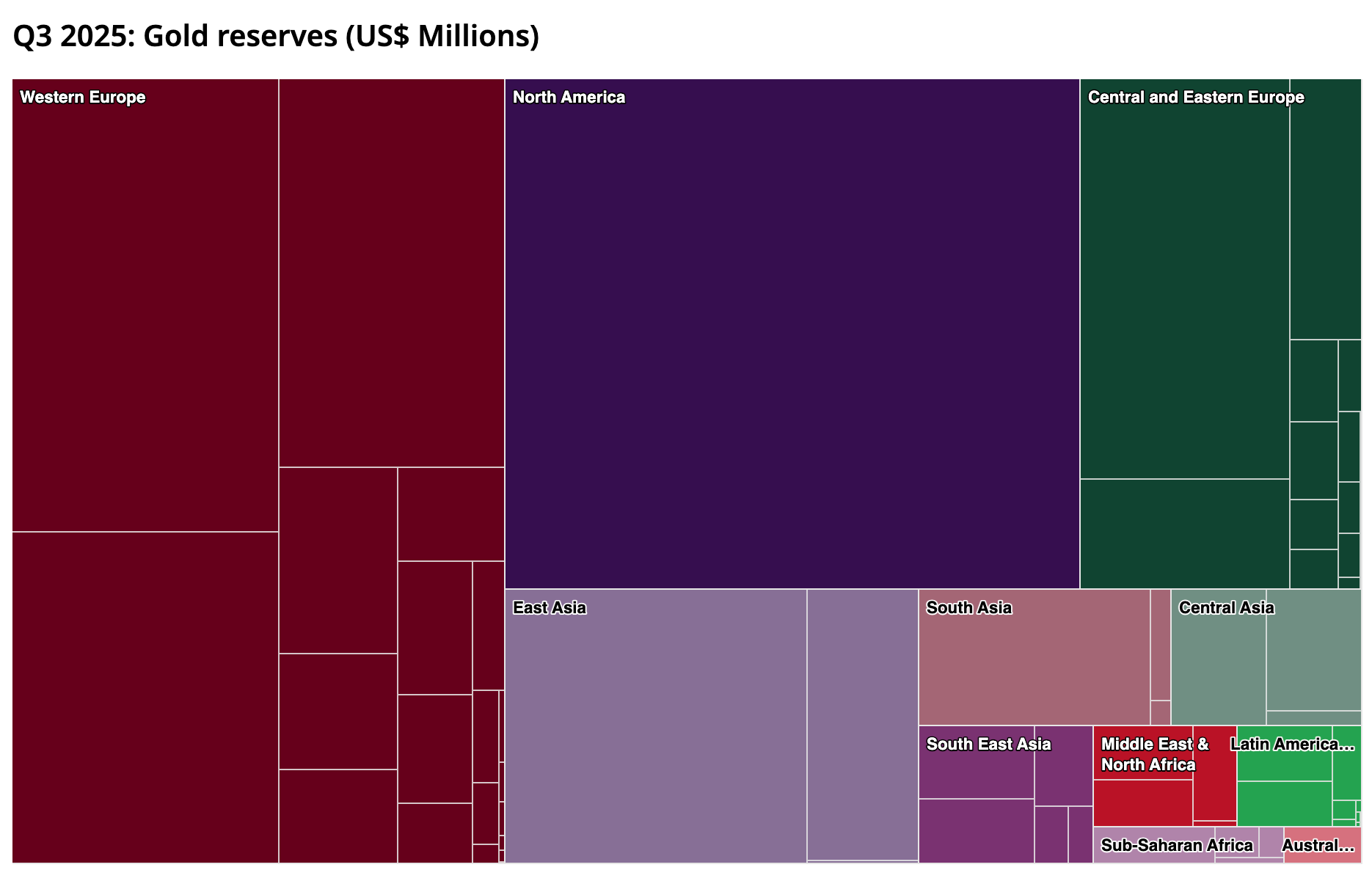

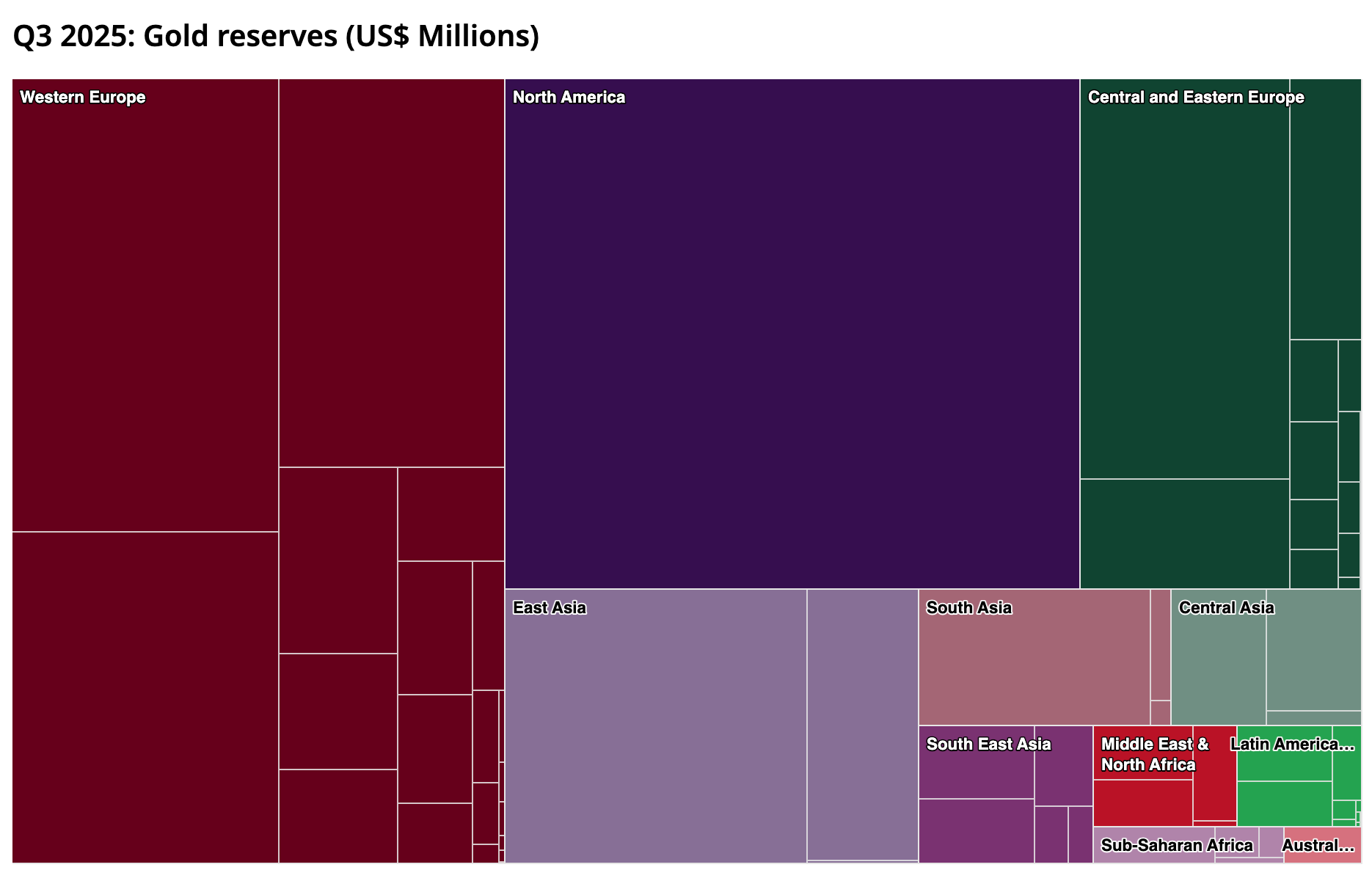

Central bank buying formed the backbone of gold’s resilience at elevated levels. Global central banks have remained net buyers for multiple consecutive years. In the first three quarters of 2025 alone, net purchases reached 634 tonnes, with full-year demand expected to exceed 1,200 tonnes. The People’s Bank of China, in particular, added gold for 13 straight months, lifting gold’s share in its FX reserves to a record high.

What stood out even more was the breakdown of traditional correlations. Under conventional trading logic, gold typically moves inversely to interest rates or risk assets. Yet over the past year, gold and U.S. equities rose side by side—an unusual and telling development. This signals a fundamental shift in how the market is pricing gold.

As the year draws to a close, traders are asking two key questions: can the bullish momentum of 2025 extend into 2026? And what forces may continue to support gold—or cap its upside—from here?

What Drove Gold Higher in 2025?

Gold’s rally in 2025 was not the result of a single catalyst, but rather the convergence of several powerful forces.

Central bank buying formed the backbone of gold’s resilience at elevated levels. Global central banks have remained net buyers for multiple consecutive years. In the first three quarters of 2025 alone, net purchases reached 634 tonnes, with full-year demand expected to exceed 1,200 tonnes. The People’s Bank of China, in particular, added gold for 13 straight months, lifting gold’s share in its FX reserves to a record high.

At a deeper level, this reflects a structural shift in the global monetary system. Concerns over U.S. fiscal sustainability and the erosion of dollar credibility have accelerated reserve diversification. Gold—sanction-proof and strategically neutral—has emerged as a preferred anchor asset. This demand is both cycle-insensitive and price-insensitive, effectively lifting gold’s long-term valuation floor.

At the same time, expectations of lower rates and a weaker USD reduced the opportunity cost of holding gold. Throughout 2025, markets increasingly priced in the Fed’s next rate cut, pushing yields lower and weighing on the dollar—both supportive for a non-yielding asset priced in USD. Improved global liquidity conditions associated with easing cycles added another tailwind.

Geopolitical and macro uncertainty also played a critical role. Persistent tensions across Ukraine, the Middle East, and parts of Southeast Asia continued to disrupt financial systems, trade routes, and supply chains.

Meanwhile, global growth slowed and recession concerns around the U.S. economy resurfaced intermittently. Add to that policy uncertainty—ranging from volatile tariff rhetoric under Trump to perceived threats to Fed independence—and markets grew more sensitive to systemic risk. In such an environment, gold’s appeal as a hedge remained strong.

Finally, price momentum itself reinforced the trend. Global gold ETFs saw cumulative inflows of around USD 77 billion in 2025, highlighting the importance of sentiment and structural shifts in driving demand. Asia—particularly China and India—stood out, with retail and institutional demand for both physical gold and ETFs surging. Rising prices attracted incremental capital, which in turn pushed prices higher, creating a self-reinforcing loop.

Taken together, central bank buying, safe-haven demand from geopolitical and economic uncertainty, and strong ETF inflows provided gold with demand largely independent of interest rates or equity market performance. Also, falling yields and a weaker dollar lowered holding costs.

Capital flowed simultaneously into equities and gold under a dual logic of return-seeking and risk hedging—producing the rare phenomenon of synchronized gains.

Can Gold Stay Strong in 2026?

Looking ahead to 2026, I think gold still has upside potential—but a repeat of 2025’s extreme gains looks unlikely. Whether the U.S. economy slips into recession, or whether the narrative of U.S. exceptionalism regains traction, will be key in defining gold’s upside range. Beyond that, data releases and event risk are likely to shape short-term trading rhythms rather than the broader trend.

From a strategic perspective, it matters less to pinpoint an exact price level than to understand gold’s role across different macro scenarios. Central bank buying, physical demand, and geopolitical hedging remain medium- to long-term anchors, while Fed policy and real rates continue to drive cyclical swings. Broadly, three scenarios stand out:

- Base case:If global growth slows modestly and the Fed continues its easing cycle, real rates are likely to drift lower while the dollar weakens. This reduces the opportunity cost of holding gold and supports further gains. In this environment, gold behaves more like a “defensive growth” asset—delivering steady positive returns rather than explosive rallies.

- Bull case:If the global economy falls into a “vicious cycle”—with recession signals intensifying, trade tensions escalating, and geopolitical risks surging—tail risks could materialize. Safe-haven demand may be released all at once, driving sharp short-term spikes in gold prices. While this scenario has a low probability, its impact would be significant. In such a case, markets may actively speculate on Fed and Trump-led rescue measures, with simultaneous fiscal and monetary easing further amplifying gold’s upside.

- Bear case:If U.S. economic resilience surprises to the upside, the exceptionalism narrative returns, fiscal stimulus ramps up ahead of midterm elections, and signs of re-inflation emerge, the Fed may be forced to keep rates higher for longer. Gold could then face corrective pressure. However, such pullbacks would likely resemble valuation adjustments rather than a breakdown in market structure. Equity market volatility also poses an additional risk—forced deleveraging could prompt traders to liquidate even safe-haven assets to raise cash, temporarily weighing on gold.

It is also worth noting that the buyer base is expanding. Beyond central banks, institutions, retail traders, and physical demand, new entrants—such as stablecoin issuers like Tether and certain corporate treasury departments—are beginning to allocate to gold. This broader capital base adds resilience to demand. Even in the face of corrections, gold’s strategic role in global portfolios appears firmly entrenched.

Trading Gold in 2026: Balancing Discipline and Flexibility

Heading into 2026, gold remains supported by multiple structural tailwinds: persistent central bank buying, a dollar and rate environment broadly favorable to gold, and elevated geopolitical and macro uncertainty. In other words, the path of least resistance still points higher.

For traders, the key is to recognize gold’s evolving role and adapt positioning to different macro regimes. In a mild slowdown or downturn, buying on dips remains a core strategy. In the event of extreme risk-off shocks, selectively adding exposure may help capture short-term upside.

Conversely, if growth surprises to the upside or the dollar strengthens materially, reducing exposure or hedging becomes essential to manage downside risk. Short-term XAUUSD volatility, cross-currency opportunities driven by global policy divergence, and shifts in ETF flows all offer valuable trading signals.

Opportunities along the gold supply chain also deserve attention. Rising gold prices directly improve profitability across mining and related industries, creating additional trading and investment angles. Price transmission along the value chain not only offers speculative opportunities, but also provides useful insight into broader gold market dynamics.

Overall, the gold market in 2026 calls for a combination of clear-headed macro analysis and tactical flexibility—capturing short-term opportunities while respecting gold’s enduring value as a medium- to long-term strategic allocation.

At a deeper level, this reflects a structural shift in the global monetary system. Concerns over U.S. fiscal sustainability and the erosion of dollar credibility have accelerated reserve diversification. Gold—sanction-proof and strategically neutral—has emerged as a preferred anchor asset. This demand is both cycle-insensitive and price-insensitive, effectively lifting gold’s long-term valuation floor.

At the same time, expectations of lower rates and a weaker USD reduced the opportunity cost of holding gold. Throughout 2025, markets increasingly priced in the Fed’s next rate cut, pushing yields lower and weighing on the dollar—both supportive for a non-yielding asset priced in USD. Improved global liquidity conditions associated with easing cycles added another tailwind.

Geopolitical and macro uncertainty also played a critical role. Persistent tensions across Ukraine, the Middle East, and parts of Southeast Asia continued to disrupt financial systems, trade routes, and supply chains.

Meanwhile, global growth slowed and recession concerns around the U.S. economy resurfaced intermittently. Add to that policy uncertainty—ranging from volatile tariff rhetoric under Trump to perceived threats to Fed independence—and markets grew more sensitive to systemic risk. In such an environment, gold’s appeal as a hedge remained strong.

Finally, price momentum itself reinforced the trend. Global gold ETFs saw cumulative inflows of around USD 77 billion in 2025, highlighting the importance of sentiment and structural shifts in driving demand. Asia—particularly China and India—stood out, with retail and institutional demand for both physical gold and ETFs surging. Rising prices attracted incremental capital, which in turn pushed prices higher, creating a self-reinforcing loop.

Taken together, central bank buying, safe-haven demand from geopolitical and economic uncertainty, and strong ETF inflows provided gold with demand largely independent of interest rates or equity market performance. Also, falling yields and a weaker dollar lowered holding costs.

Capital flowed simultaneously into equities and gold under a dual logic of return-seeking and risk hedging—producing the rare phenomenon of synchronized gains.

Can Gold Stay Strong in 2026?

Looking ahead to 2026, I think gold still has upside potential—but a repeat of 2025’s extreme gains looks unlikely. Whether the U.S. economy slips into recession, or whether the narrative of U.S. exceptionalism regains traction, will be key in defining gold’s upside range. Beyond that, data releases and event risk are likely to shape short-term trading rhythms rather than the broader trend.

From a strategic perspective, it matters less to pinpoint an exact price level than to understand gold’s role across different macro scenarios. Central bank buying, physical demand, and geopolitical hedging remain medium- to long-term anchors, while Fed policy and real rates continue to drive cyclical swings. Broadly, three scenarios stand out:

- Base case:If global growth slows modestly and the Fed continues its easing cycle, real rates are likely to drift lower while the dollar weakens. This reduces the opportunity cost of holding gold and supports further gains. In this environment, gold behaves more like a “defensive growth” asset—delivering steady positive returns rather than explosive rallies.

- Bull case:If the global economy falls into a “vicious cycle”—with recession signals intensifying, trade tensions escalating, and geopolitical risks surging—tail risks could materialize. Safe-haven demand may be released all at once, driving sharp short-term spikes in gold prices. While this scenario has a low probability, its impact would be significant. In such a case, markets may actively speculate on Fed and Trump-led rescue measures, with simultaneous fiscal and monetary easing further amplifying gold’s upside.

- Bear case:If U.S. economic resilience surprises to the upside, the exceptionalism narrative returns, fiscal stimulus ramps up ahead of midterm elections, and signs of re-inflation emerge, the Fed may be forced to keep rates higher for longer. Gold could then face corrective pressure. However, such pullbacks would likely resemble valuation adjustments rather than a breakdown in market structure. Equity market volatility also poses an additional risk—forced deleveraging could prompt traders to liquidate even safe-haven assets to raise cash, temporarily weighing on gold.

It is also worth noting that the buyer base is expanding. Beyond central banks, institutions, retail traders, and physical demand, new entrants—such as stablecoin issuers like Tether and certain corporate treasury departments—are beginning to allocate to gold. This broader capital base adds resilience to demand. Even in the face of corrections, gold’s strategic role in global portfolios appears firmly entrenched.

Trading Gold in 2026: Balancing Discipline and Flexibility

Heading into 2026, gold remains supported by multiple structural tailwinds: persistent central bank buying, a dollar and rate environment broadly favorable to gold, and elevated geopolitical and macro uncertainty. In other words, the path of least resistance still points higher.

For traders, the key is to recognize gold’s evolving role and adapt positioning to different macro regimes. In a mild slowdown or downturn, buying on dips remains a core strategy. In the event of extreme risk-off shocks, selectively adding exposure may help capture short-term upside.

Conversely, if growth surprises to the upside or the dollar strengthens materially, reducing exposure or hedging becomes essential to manage downside risk. Short-term XAUUSD volatility, cross-currency opportunities driven by global policy divergence, and shifts in ETF flows all offer valuable trading signals.

Opportunities along the gold supply chain also deserve attention. Rising gold prices directly improve profitability across mining and related industries, creating additional trading and investment angles. Price transmission along the value chain not only offers speculative opportunities, but also provides useful insight into broader gold market dynamics.

Overall, the gold market in 2026 calls for a combination of clear-headed macro analysis and tactical flexibility—capturing short-term opportunities while respecting gold’s enduring value as a medium- to long-term strategic allocation. Disclaimer:

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn't represent that the material provided here is accurate, current or complete, and therefore shouldn't be relied upon as such. The information, whether from a third party or not, isn't to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers' financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn't permitted.

Publication date:

2025-12-22 10:48:07 (GMT)

Gold Outlook for 2026: Ongoing central bank buying, shifts in the dollar and interest rates, geopolitics, and ETF flows continue to underpin prices. The price anchor is likely to move higher—while rational and flexible positioning remains key.

Looking back at 2025, gold delivered one of the most striking performances across global markets. Prices repeatedly pushed to new highs, breaking historical records more than 50 times, with peak gains reaching as much as 67%.

In historical terms, this marked the strongest annual performance since 1979. In relative terms, gold significantly outperformed major equity benchmarks such as the S&P 500 and the Nasdaq.

Gold Outlook for 2026: Ongoing central bank buying, shifts in the dollar and interest rates, geopolitics, and ETF flows continue to underpin prices. The price anchor is likely to move higher—while rational and flexible positioning remains key.

Looking back at 2025, gold delivered one of the most striking performances across global markets. Prices repeatedly pushed to new highs, breaking historical records more than 50 times, with peak gains reaching as much as 67%.

In historical terms, this marked the strongest annual performance since 1979. In relative terms, gold significantly outperformed major equity benchmarks such as the S&P 500 and the Nasdaq.

What stood out even more was the breakdown of traditional correlations. Under conventional trading logic, gold typically moves inversely to interest rates or risk assets. Yet over the past year, gold and U.S. equities rose side by side—an unusual and telling development. This signals a fundamental shift in how the market is pricing gold.

As the year draws to a close, traders are asking two key questions: can the bullish momentum of 2025 extend into 2026? And what forces may continue to support gold—or cap its upside—from here?

What Drove Gold Higher in 2025?

Gold’s rally in 2025 was not the result of a single catalyst, but rather the convergence of several powerful forces.

Central bank buying formed the backbone of gold’s resilience at elevated levels. Global central banks have remained net buyers for multiple consecutive years. In the first three quarters of 2025 alone, net purchases reached 634 tonnes, with full-year demand expected to exceed 1,200 tonnes. The People’s Bank of China, in particular, added gold for 13 straight months, lifting gold’s share in its FX reserves to a record high.

What stood out even more was the breakdown of traditional correlations. Under conventional trading logic, gold typically moves inversely to interest rates or risk assets. Yet over the past year, gold and U.S. equities rose side by side—an unusual and telling development. This signals a fundamental shift in how the market is pricing gold.

As the year draws to a close, traders are asking two key questions: can the bullish momentum of 2025 extend into 2026? And what forces may continue to support gold—or cap its upside—from here?

What Drove Gold Higher in 2025?

Gold’s rally in 2025 was not the result of a single catalyst, but rather the convergence of several powerful forces.

Central bank buying formed the backbone of gold’s resilience at elevated levels. Global central banks have remained net buyers for multiple consecutive years. In the first three quarters of 2025 alone, net purchases reached 634 tonnes, with full-year demand expected to exceed 1,200 tonnes. The People’s Bank of China, in particular, added gold for 13 straight months, lifting gold’s share in its FX reserves to a record high.

At a deeper level, this reflects a structural shift in the global monetary system. Concerns over U.S. fiscal sustainability and the erosion of dollar credibility have accelerated reserve diversification. Gold—sanction-proof and strategically neutral—has emerged as a preferred anchor asset. This demand is both cycle-insensitive and price-insensitive, effectively lifting gold’s long-term valuation floor.

At the same time, expectations of lower rates and a weaker USD reduced the opportunity cost of holding gold. Throughout 2025, markets increasingly priced in the Fed’s next rate cut, pushing yields lower and weighing on the dollar—both supportive for a non-yielding asset priced in USD. Improved global liquidity conditions associated with easing cycles added another tailwind.

Geopolitical and macro uncertainty also played a critical role. Persistent tensions across Ukraine, the Middle East, and parts of Southeast Asia continued to disrupt financial systems, trade routes, and supply chains.

Meanwhile, global growth slowed and recession concerns around the U.S. economy resurfaced intermittently. Add to that policy uncertainty—ranging from volatile tariff rhetoric under Trump to perceived threats to Fed independence—and markets grew more sensitive to systemic risk. In such an environment, gold’s appeal as a hedge remained strong.

Finally, price momentum itself reinforced the trend. Global gold ETFs saw cumulative inflows of around USD 77 billion in 2025, highlighting the importance of sentiment and structural shifts in driving demand. Asia—particularly China and India—stood out, with retail and institutional demand for both physical gold and ETFs surging. Rising prices attracted incremental capital, which in turn pushed prices higher, creating a self-reinforcing loop.

Taken together, central bank buying, safe-haven demand from geopolitical and economic uncertainty, and strong ETF inflows provided gold with demand largely independent of interest rates or equity market performance. Also, falling yields and a weaker dollar lowered holding costs.

Capital flowed simultaneously into equities and gold under a dual logic of return-seeking and risk hedging—producing the rare phenomenon of synchronized gains.

Can Gold Stay Strong in 2026?

Looking ahead to 2026, I think gold still has upside potential—but a repeat of 2025’s extreme gains looks unlikely. Whether the U.S. economy slips into recession, or whether the narrative of U.S. exceptionalism regains traction, will be key in defining gold’s upside range. Beyond that, data releases and event risk are likely to shape short-term trading rhythms rather than the broader trend.

From a strategic perspective, it matters less to pinpoint an exact price level than to understand gold’s role across different macro scenarios. Central bank buying, physical demand, and geopolitical hedging remain medium- to long-term anchors, while Fed policy and real rates continue to drive cyclical swings. Broadly, three scenarios stand out:

- Base case:If global growth slows modestly and the Fed continues its easing cycle, real rates are likely to drift lower while the dollar weakens. This reduces the opportunity cost of holding gold and supports further gains. In this environment, gold behaves more like a “defensive growth” asset—delivering steady positive returns rather than explosive rallies.

- Bull case:If the global economy falls into a “vicious cycle”—with recession signals intensifying, trade tensions escalating, and geopolitical risks surging—tail risks could materialize. Safe-haven demand may be released all at once, driving sharp short-term spikes in gold prices. While this scenario has a low probability, its impact would be significant. In such a case, markets may actively speculate on Fed and Trump-led rescue measures, with simultaneous fiscal and monetary easing further amplifying gold’s upside.

- Bear case:If U.S. economic resilience surprises to the upside, the exceptionalism narrative returns, fiscal stimulus ramps up ahead of midterm elections, and signs of re-inflation emerge, the Fed may be forced to keep rates higher for longer. Gold could then face corrective pressure. However, such pullbacks would likely resemble valuation adjustments rather than a breakdown in market structure. Equity market volatility also poses an additional risk—forced deleveraging could prompt traders to liquidate even safe-haven assets to raise cash, temporarily weighing on gold.

It is also worth noting that the buyer base is expanding. Beyond central banks, institutions, retail traders, and physical demand, new entrants—such as stablecoin issuers like Tether and certain corporate treasury departments—are beginning to allocate to gold. This broader capital base adds resilience to demand. Even in the face of corrections, gold’s strategic role in global portfolios appears firmly entrenched.

Trading Gold in 2026: Balancing Discipline and Flexibility

Heading into 2026, gold remains supported by multiple structural tailwinds: persistent central bank buying, a dollar and rate environment broadly favorable to gold, and elevated geopolitical and macro uncertainty. In other words, the path of least resistance still points higher.

For traders, the key is to recognize gold’s evolving role and adapt positioning to different macro regimes. In a mild slowdown or downturn, buying on dips remains a core strategy. In the event of extreme risk-off shocks, selectively adding exposure may help capture short-term upside.

Conversely, if growth surprises to the upside or the dollar strengthens materially, reducing exposure or hedging becomes essential to manage downside risk. Short-term XAUUSD volatility, cross-currency opportunities driven by global policy divergence, and shifts in ETF flows all offer valuable trading signals.

Opportunities along the gold supply chain also deserve attention. Rising gold prices directly improve profitability across mining and related industries, creating additional trading and investment angles. Price transmission along the value chain not only offers speculative opportunities, but also provides useful insight into broader gold market dynamics.

Overall, the gold market in 2026 calls for a combination of clear-headed macro analysis and tactical flexibility—capturing short-term opportunities while respecting gold’s enduring value as a medium- to long-term strategic allocation.

At a deeper level, this reflects a structural shift in the global monetary system. Concerns over U.S. fiscal sustainability and the erosion of dollar credibility have accelerated reserve diversification. Gold—sanction-proof and strategically neutral—has emerged as a preferred anchor asset. This demand is both cycle-insensitive and price-insensitive, effectively lifting gold’s long-term valuation floor.

At the same time, expectations of lower rates and a weaker USD reduced the opportunity cost of holding gold. Throughout 2025, markets increasingly priced in the Fed’s next rate cut, pushing yields lower and weighing on the dollar—both supportive for a non-yielding asset priced in USD. Improved global liquidity conditions associated with easing cycles added another tailwind.

Geopolitical and macro uncertainty also played a critical role. Persistent tensions across Ukraine, the Middle East, and parts of Southeast Asia continued to disrupt financial systems, trade routes, and supply chains.

Meanwhile, global growth slowed and recession concerns around the U.S. economy resurfaced intermittently. Add to that policy uncertainty—ranging from volatile tariff rhetoric under Trump to perceived threats to Fed independence—and markets grew more sensitive to systemic risk. In such an environment, gold’s appeal as a hedge remained strong.

Finally, price momentum itself reinforced the trend. Global gold ETFs saw cumulative inflows of around USD 77 billion in 2025, highlighting the importance of sentiment and structural shifts in driving demand. Asia—particularly China and India—stood out, with retail and institutional demand for both physical gold and ETFs surging. Rising prices attracted incremental capital, which in turn pushed prices higher, creating a self-reinforcing loop.

Taken together, central bank buying, safe-haven demand from geopolitical and economic uncertainty, and strong ETF inflows provided gold with demand largely independent of interest rates or equity market performance. Also, falling yields and a weaker dollar lowered holding costs.

Capital flowed simultaneously into equities and gold under a dual logic of return-seeking and risk hedging—producing the rare phenomenon of synchronized gains.

Can Gold Stay Strong in 2026?

Looking ahead to 2026, I think gold still has upside potential—but a repeat of 2025’s extreme gains looks unlikely. Whether the U.S. economy slips into recession, or whether the narrative of U.S. exceptionalism regains traction, will be key in defining gold’s upside range. Beyond that, data releases and event risk are likely to shape short-term trading rhythms rather than the broader trend.

From a strategic perspective, it matters less to pinpoint an exact price level than to understand gold’s role across different macro scenarios. Central bank buying, physical demand, and geopolitical hedging remain medium- to long-term anchors, while Fed policy and real rates continue to drive cyclical swings. Broadly, three scenarios stand out:

- Base case:If global growth slows modestly and the Fed continues its easing cycle, real rates are likely to drift lower while the dollar weakens. This reduces the opportunity cost of holding gold and supports further gains. In this environment, gold behaves more like a “defensive growth” asset—delivering steady positive returns rather than explosive rallies.

- Bull case:If the global economy falls into a “vicious cycle”—with recession signals intensifying, trade tensions escalating, and geopolitical risks surging—tail risks could materialize. Safe-haven demand may be released all at once, driving sharp short-term spikes in gold prices. While this scenario has a low probability, its impact would be significant. In such a case, markets may actively speculate on Fed and Trump-led rescue measures, with simultaneous fiscal and monetary easing further amplifying gold’s upside.

- Bear case:If U.S. economic resilience surprises to the upside, the exceptionalism narrative returns, fiscal stimulus ramps up ahead of midterm elections, and signs of re-inflation emerge, the Fed may be forced to keep rates higher for longer. Gold could then face corrective pressure. However, such pullbacks would likely resemble valuation adjustments rather than a breakdown in market structure. Equity market volatility also poses an additional risk—forced deleveraging could prompt traders to liquidate even safe-haven assets to raise cash, temporarily weighing on gold.

It is also worth noting that the buyer base is expanding. Beyond central banks, institutions, retail traders, and physical demand, new entrants—such as stablecoin issuers like Tether and certain corporate treasury departments—are beginning to allocate to gold. This broader capital base adds resilience to demand. Even in the face of corrections, gold’s strategic role in global portfolios appears firmly entrenched.

Trading Gold in 2026: Balancing Discipline and Flexibility

Heading into 2026, gold remains supported by multiple structural tailwinds: persistent central bank buying, a dollar and rate environment broadly favorable to gold, and elevated geopolitical and macro uncertainty. In other words, the path of least resistance still points higher.

For traders, the key is to recognize gold’s evolving role and adapt positioning to different macro regimes. In a mild slowdown or downturn, buying on dips remains a core strategy. In the event of extreme risk-off shocks, selectively adding exposure may help capture short-term upside.

Conversely, if growth surprises to the upside or the dollar strengthens materially, reducing exposure or hedging becomes essential to manage downside risk. Short-term XAUUSD volatility, cross-currency opportunities driven by global policy divergence, and shifts in ETF flows all offer valuable trading signals.

Opportunities along the gold supply chain also deserve attention. Rising gold prices directly improve profitability across mining and related industries, creating additional trading and investment angles. Price transmission along the value chain not only offers speculative opportunities, but also provides useful insight into broader gold market dynamics.

Overall, the gold market in 2026 calls for a combination of clear-headed macro analysis and tactical flexibility—capturing short-term opportunities while respecting gold’s enduring value as a medium- to long-term strategic allocation.